Long-Term Small Business Loans 2023

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

What Is a Long-Term Business Loan?

How do Long-Term Business Loans Work?

Higher loan amounts than short-term business loans Lower interest rates compared to short-term financing Collateral is often needed Qualifications will vary by lender but generally include an established business history, a strong credit history, and proof of financials

Long-Term Business Loans Uses

Real estate purchases Building renovations Equipment financing Debt refinancing Purchasing another business

Who is Eligible for a Long-Term Business Loan?

Businesses that have been established for more than 2 years Those with strong business and personal credit Businesses with a proven track record of generating revenue Businesses with collateral to offer Borrowers who own a large percentage of their business

Typical Rates and Fees for Long-Term Small Business Loans

Application or origination fees: Charge for processing your application and setting up the account Underwriting fees: Help cover costs of verifying documents and credit reports Prepayment Penalties: Some lenders may charge fees if you pay back the loan early Service fees: Cover ongoing costs related to your account SBA loan guarantee fee: If you get an SBA loan, they have a guarantee fee of 0.25% to 3.75% depending on the size of the loan. The guarantee fee is charged to the lender, but can be passed on to the borrower.

Who Offers Long-Term Business Loans?

Common Long-Term Business Loan Terms

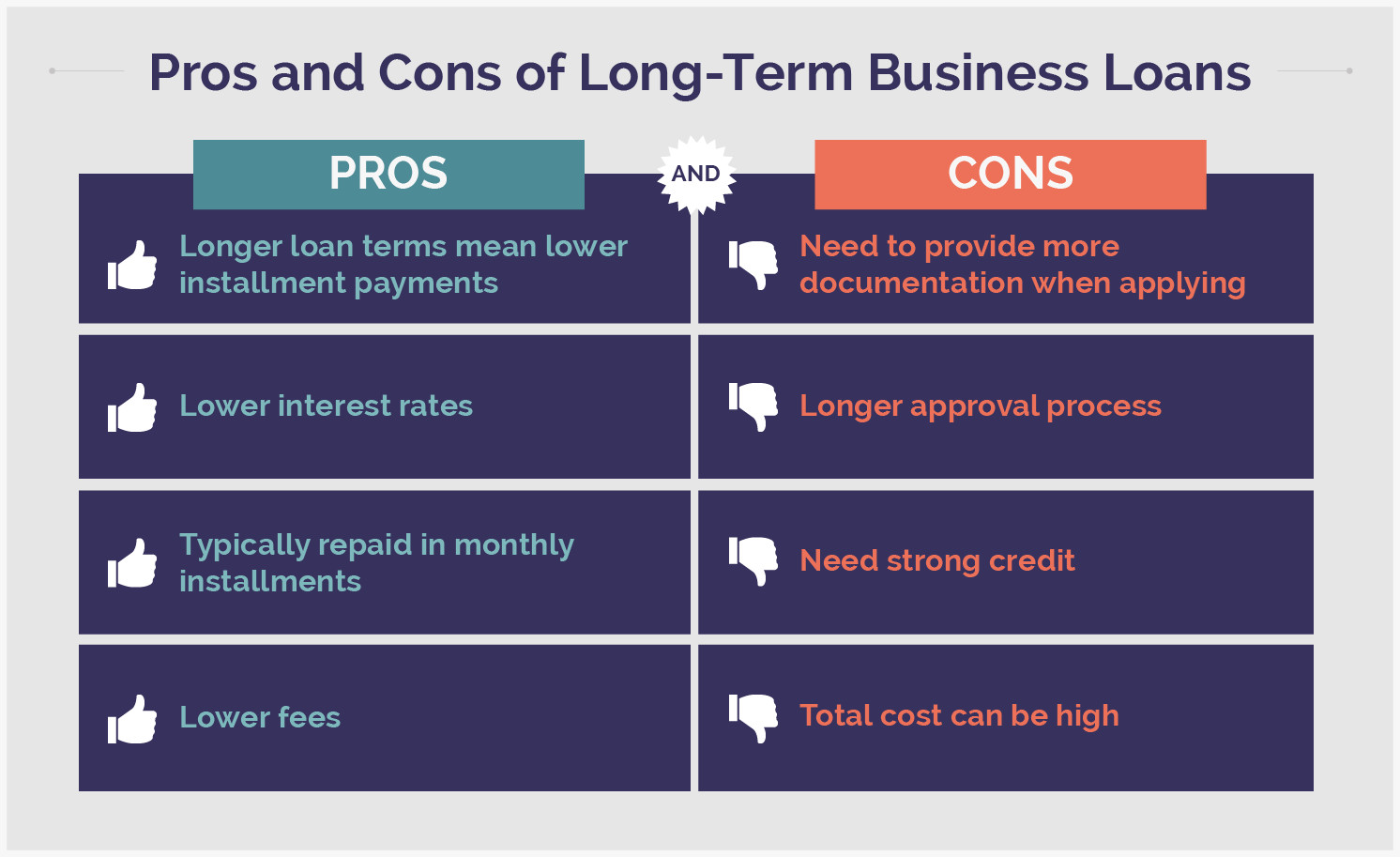

Pros and Cons of Long-Term Business Loans

Pros of Long-Term Lending Options

Longer Loan Terms Make for Lower Payments

Lower Interest Rates

Monthly Payments

Lower Fees

Cons of Long-Term Business Loans

Longer Approval Process

Need Strong Credit

More Documentation to Prove Creditworthiness

Total Cost Can Be High

Long-Term vs. Short-Term Business Loans

Types of Long-Term Business Loans

SBA Loans

SBA 7(a): Long-term small business loans that can be used for nearly any business-related purchase. The maximum loan amount is $5 million, and loan terms may extend up to 25 years, depending on what the funds will be used for. SBA 504: Small business loans aimed at helping businesses renovate or modernize their operation. The funds can be used for purposes like purchasing new land, remodeling, or buying new equipment. The maximum loan amount is $5 million and loan terms can extend up to 25 years.

Term Loans

Business Line of Credit

Equipment Financing

Commercial Real Estate Loans

Applying for a Long-Term Business Loan

1. Understanding Qualifications

Be well-established and in business over two years Have strong personal and business credit histories Be able to show proof of annual revenue

2. Checking Your Business and Personal Credit

3. Preparing documentation

Personal and business tax returns Personal and business credit scores Profit and loss statements Business licenses, permits or other legal documentation Personal and business bank statements Documents for proof of collateral

4. Choosing a Lender

How much financing do I need? What is the money being used for? How soon do I need funding? Can I honestly afford a long-term loan?

5. Applying

Additional Funding Options for Small Businesses

Microloan

Peer-to-Peer (P2P) Lending

Inventory Financing

Compare Long-Term Business Loans with Lantern

Frequently Asked Questions

LCSB0223010

About the Author

Nancy Bilyeau writes about student loans, mortgages, car insurance, medical debt and many other finance topics for Lantern. A veteran of the magazine business, she has edited stories on personal finance for Good Housekeeping and DuJour magazines and has written articles for The Wall Street Journal, Readers' Digest, Parade, Town & Country and Lifetime/A&E, among others. She is a graduate of the University of Michigan.

Share this article: