Guide to SBA Loans and How to Apply to Them

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

What Is an SBA Loan?

How does the business receive income? What is the character of its ownership? Where does the business operate? Does the business meet size standards? Has the business received funds from another financial lender?

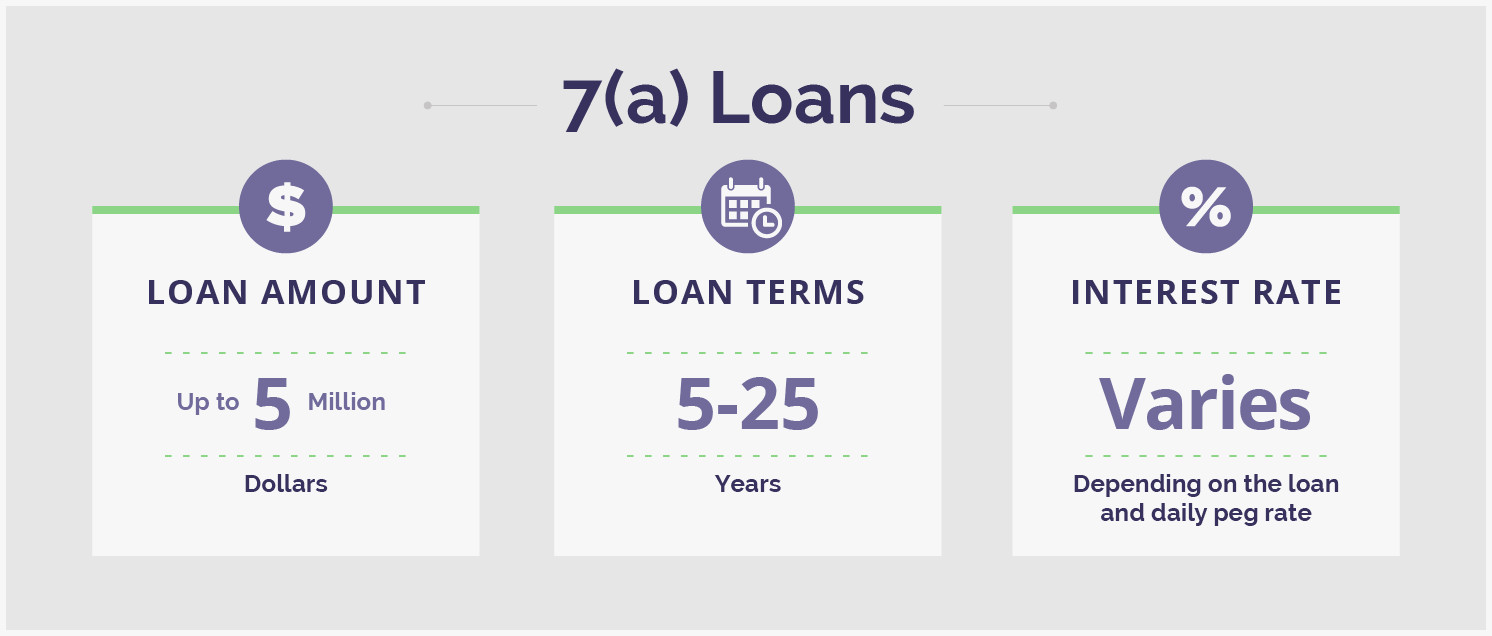

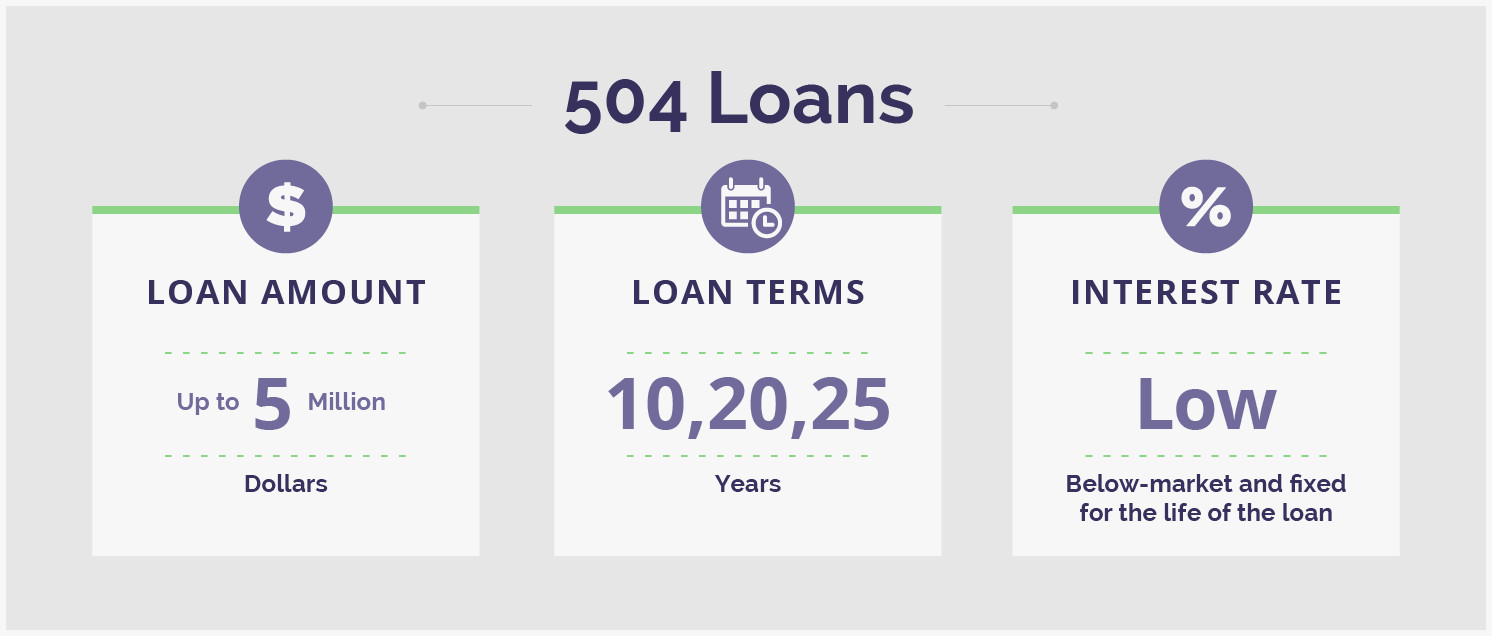

SBA Loan Terms, Amounts, and Rates

Standard Small Express CAPLines Export Working Capital Export Express International Trade

SBA Loan Terms

Working capital, the maximum maturity is 10 years. Equipment, the maximum maturity is 10 years as long as it does not exceed the life of the equipment. Inventory, the maximum maturity is 10 years. Real estate, the maximum maturity is 25 years.

504 loans, the loan terms can be 10, 20, or 25 years. Microloans, the maximum maturity is 6 years. All CAPLine loans except the Builders CAPLine, the maximum maturity is 10 years. Builders CAPLine loans, the maximum maturity is 5 years. International Trade, the maximum maturity is 25 years. Export Working Capital, the maximum maturity is typically 1 year, but can be up to 3.

Economic Injury Disaster Loan (EIDL), the maximum maturity is 30 years. Business Physical Disaster Loan, the maximum maturity is 30 years. Military Reservists Economic Injury Loan, the maximum maturity is 30 years.

SBA Loan Amounts

Standard 7(a): $5 million 7(a) Small loan: $350,000 SBA Express: $350,000 Export Express: $500,000 Export Working Capital: $5 million International Trade: $5 million 504 loan: Generally $5 million (qualified energy-efficient or manufacturing projects may receive multiple loans up to $5.5 million) Microloan: $50,000 CAPLine loan: $5 million All disaster loans: $2 million

SBA Interest Rates

All 7(a) loans: Interest rates vary depending on the type of loan and what the daily peg rate is. As of December 2023, the interest rate for loans with a maturity of less than 7 years is 12.75%. The interest rate for loans with a maturity of more than 7 years is 13.25%. 504 loan: Interest rates are below-market and fixed for the life of the loan. In December 2023, the rate averaged at 6.21%. Microloan: Interest rates are typically between 8% and 13%. Disaster loans: Interest rates are determined by law and each type of disaster loan has its own criteria: Economic Injury Disaster Loan (EIDL): Maximum interest rate for businesses is 3.75% fixed. Business Physical Disaster Loan: Maximum interest rate is 4% if you aren’t able to obtain credit elsewhere; otherwise, 8% maximum. Military Reservists Economic Injury Disaster Loan (MREIDL): Maximum interest rate is 4%.

Who Offers SBA Loans?

6 Different Types of SBA Loans

7(a) loan programs 504 loan program Microloans SBA disaster loans

SBA 7(a) loans

Eligibility requirements

Be a for-profit business Meet SBA size standards Operate or propose to do business in the United States or its territories Have ownership that has invested equity (time and money) into the business Able to repay the loan Already exhausted all other financing options

How to apply for an SBA 7(a) loan

Year-end Profit and Loss (P&L) statement for the last 3 years Year-end balance sheet for the last three years with a detailed debt schedule Reconciliation of net worth Interim balance sheet Interim Profit & Loss statements Projected financial statements with month-to-month cash flow projections for span of at least 1 year.

Your original business certificate or license. The signed personal and business federal income tax returns from the past 3 years for all principal owners of the business. Personal resumes from all principal owners of the business. Your business lease or obtain a note from your landlord. Records of past loans your small business has applied for

A business overview, detailing the business’ past, purpose, and what an SBA loan is needed for. A list of ownership and affiliations to include names and addresses of any subsidiaries or affiliates. Also include concerns in which you hold interests or affiliations through stocks, franchises, or potential mergers.

Current balance sheet and P&L for the business to be purchased Previous 2 years of federal income tax returns Proposed Bill of Sale including Terms of Sale Asking price with schedule of inventory, machinery and equipment, furniture and fixtures

SBA 504 loans

Purchasing existing buildings Purchasing or improving land Constructing new buildings Renovating or modernizing existing buildings Purchasing long-term machinery, furniture, or equipment Refinancing debt connected to the expansion of your business

Eligibility requirements

Be a for profit business Meet SBA size standards Cannot exceed $15 million in tangible net worth Cannot have an average net income over $5 million in the 2 years prior to application

How to apply

SBA microloans

Machinery Equipment Fixtures and furniture Inventory or supplies Working capital

Eligibility Requirements

Be a newly established or growing for-profit business, or non-profit childcare center. Be located in the Intermediary’s approved region of operation. Meet the SBA’s size requirements. Never have been debarred from receiving federal funding, with verification via a completed SBA Form 1624. Not have a business owner (owns 50% or more) who is more than 60 days late on child support payments.

How to apply

SBA disaster loans

Business Physical Disaster Loans: SBA financing designed to help businesses in declared disaster areas recover from physical damage to their property. These types of loans can be used to repair or replace: Machinery Inventory Real estate Business assets Economic Injury Disaster Loans (EIDL): SBA loans designed to help businesses in declared disaster areas that have suffered substantial financial loss. Military Reservists Economic Injury Disaster Loans (MREDL): SBA funding for small businesses who have suffered financially because an essential employee was called up for service.

Eligibility requirements

Register with FEMA to get a registration number. You can start the process by visiting DisasterAssistance.gov or by calling FEMA at 1-800-621-3362. Have already exhausted funding options from your insurance company and the Federal Emergency Management Agency (FEMA). Be located in a declared disaster area.

How to apply

Contact information for all applicants Social security numbers for all applicants FEMA registration number Deed or lease information Insurance information Financial information (e.g. income, account balances, and monthly expenses) Employer Identification Number (EIN) if you are a business applicant Signed and dated IRS Form 4506-T (permission for IRS to provide tax information to SBA)

SBA CAPLines

Contract loan

The ability to operate profitably based on past completion of contracts. The ability to bid and perform the work required by the contract. Financial capacity and expertise to execute the contract on time and profitably.

Seasonal lines of credit

Have been in operation for at least 1 calendar year. Be able to show a definite pattern of seasonal activity.

Builders line

Be construction contractors or homebuilders who have managerial and technical ability. Be performing the construction work or manage alongside at least one supervisory employee on the job site over the course of construction. Plan for “prompt and significant” renovations. Show prior successful performance in bidding and finishing construction/renovation on a similar project.

Working capital line of credit

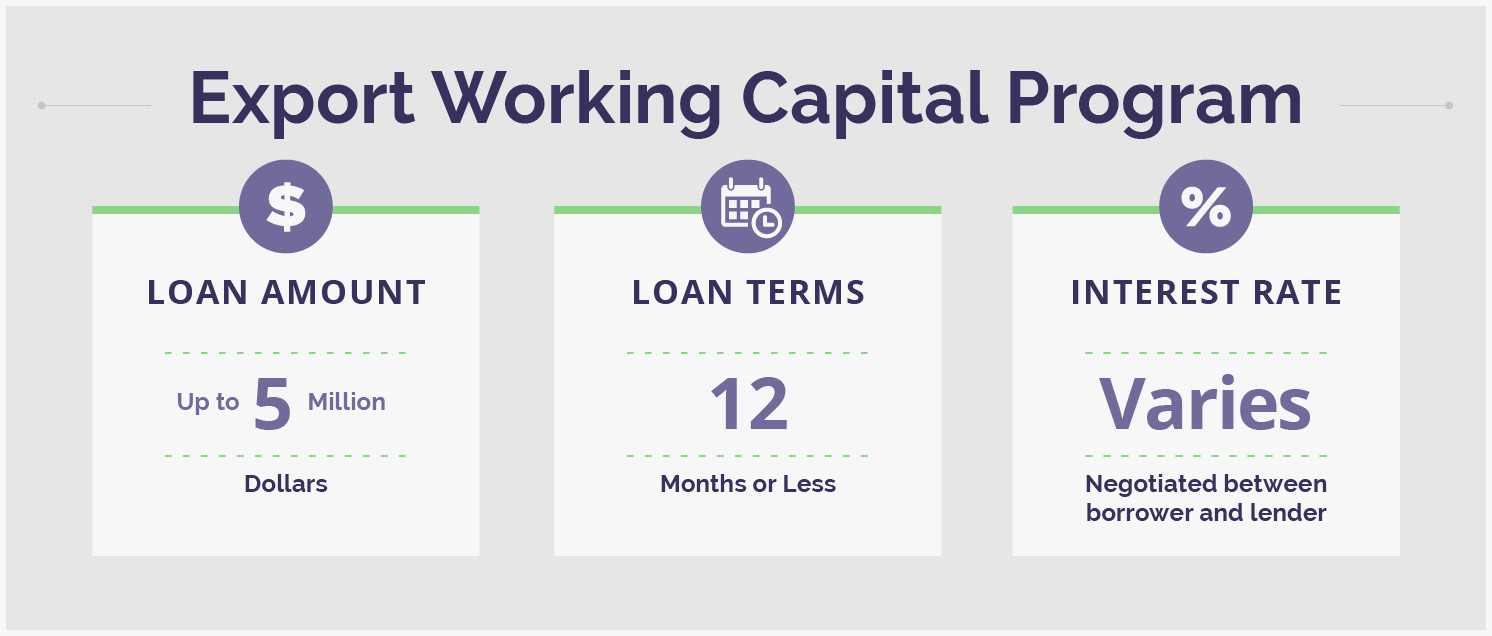

SBA Export Working Capital Program

Guaranty Coverage, Rates, and Terms

Maximum loan amount is $5,000,000 90% of principal and accrued interest up to 120 days Low guarantee fee of ¼% of the guaranteed portion for loans with maturities of 12 months or less Loan maturities are generally for 12 months or less

Eligibility Requirements

Meet the standard SBA requirements for 7(a) loans. Be a business that engages in export development. Have at least 12 months of operating experience prior to applying (which can be waived with demonstrated expertise and previous business experience).

How to Apply

Pros of SBA loans

They are designed specifically for small businesses, including those owned by women, veterans, and underserved communities. Secured loans have a percentage of each loan guaranteed by the SBA to reduce risks to lenders and provide potential borrowers with relatively favorable terms and rates. You can use funds for a variety of business purposes from start-up costs and inventory, to real estate and working capital. See individual loan conditions to learn more. May offer more competitive interest rates than a non-SBA business loan.

Cons of Choosing an SBA Loan

Application and approval processes can be longer than non-SBA loans because SBA financing is highly competitive and has strict eligibility requirements. You may need higher personal and/or business credit to qualify when compared to other online business loans. While having a lower credit score doesn’t necessarily disqualify you for an SBA loan, the minimum credit score generally falls around 620-640, but this will vary by lender. Some programs have restrictions on how you use funds.

Alternative Small Business Loan Options

Inventory financing

Business line of credit

Personal loans for small business

Equipment financing

Commercial real estate loan

Exploring Small Business Financing

LCSB0623009

About the Author

Lantern is a product comparison site that makes it easy for individuals to shop for products and compare offers with top lenders. Lantern is owned and operated by SoFi Lending Corp., the digital personal finance company that has helped over one million people get their money right.

Share this article: