How Small Businesses Used the First Round of PPP to Survive: 9 Things We Learned in 2020

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

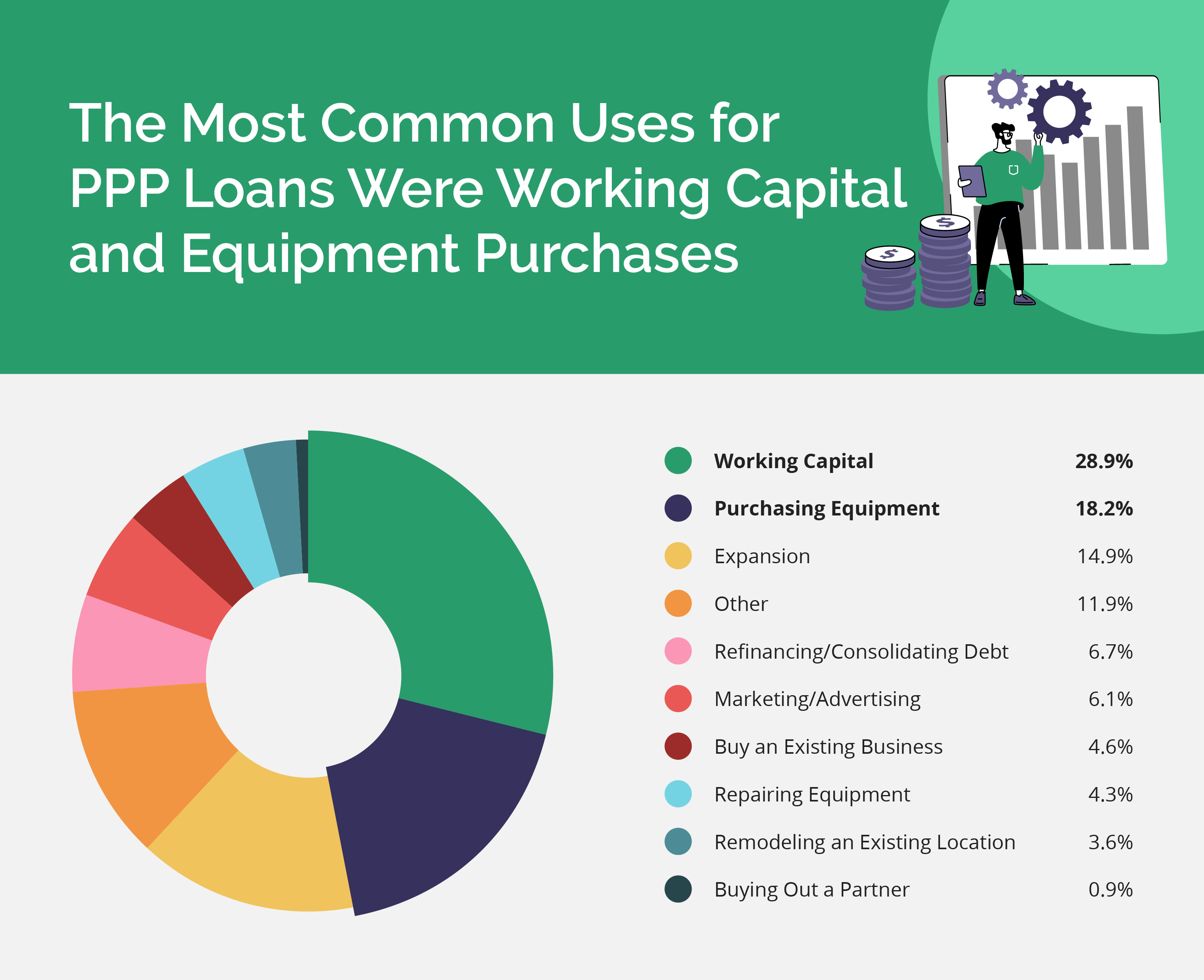

1. The most common uses for PPP were working capital and equipment purchases

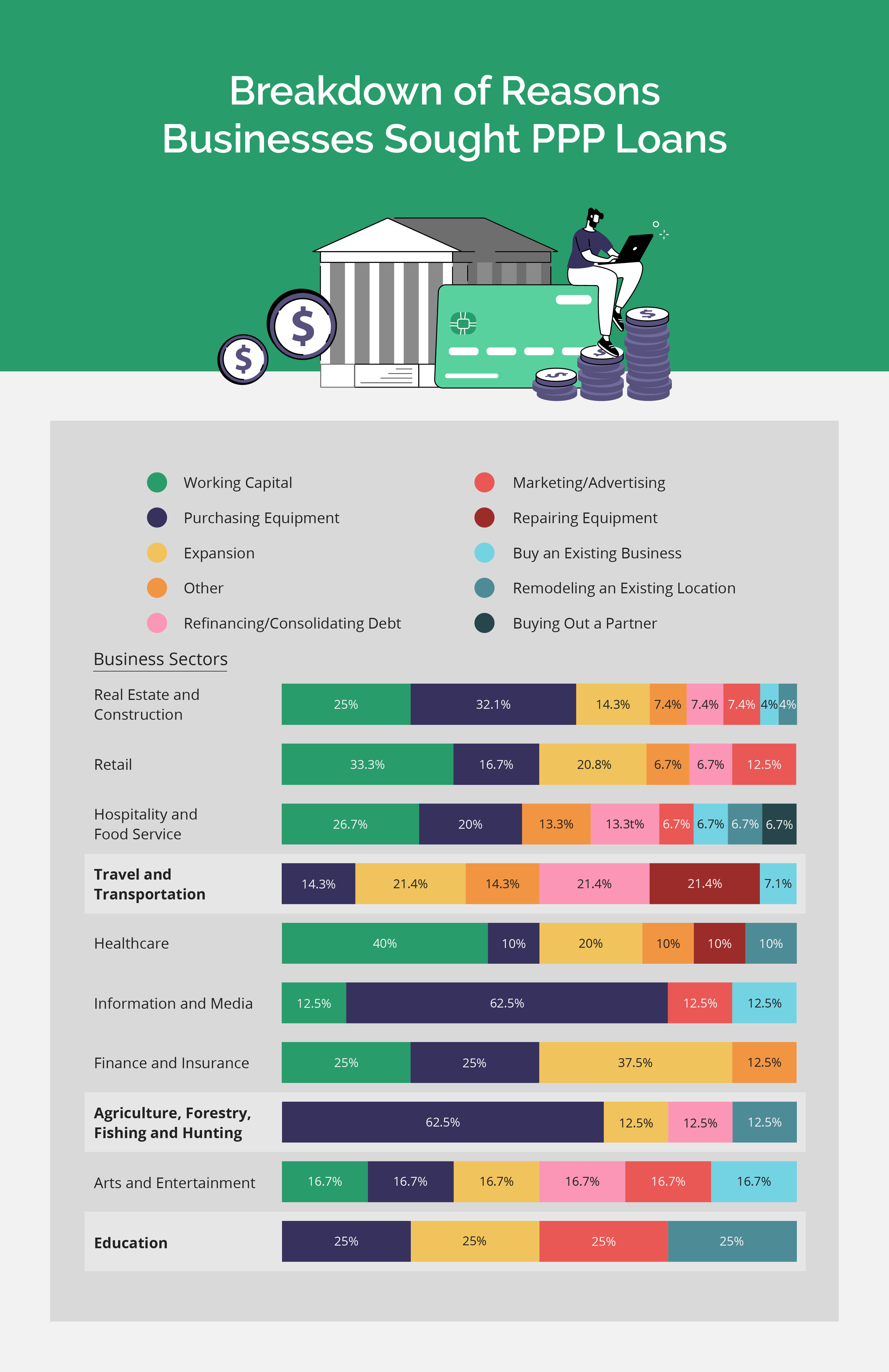

2. There were business sectors that sought PPP loans for reasons other than working capital

Travel and transportation – These businesses mainly sought PPP loans to cover expansion, refinancing and debt consolidation, and equipment purchases. Since the travel industry has been hit particularly hard during the pandemic, meaning it has less need for labor/payroll funds, it’s likely that these businesses focused on other immediate needs. Hence their desire to consolidate debts or refinance. However, some businesses sought PPP assistance for expansion and equipment purchases, which may indicate that they didn’t anticipate the long-term negative effects from the pandemic.

Agriculture, forestry, fishing, and hunting –These types of businesses overwhelmingly sought funds for equipment purchases. One possible reason might be to compensate for the large loss in labor force in this sector caused by COVIDr. In fact, 11% of all COVID cases through July 2020 were in the agriculture, forestry, fishing, and hunting sector, even though the sector makes up only 3% of the U.S. workforce.

Education – These businesses split between equipment purchases, expansion, remodeling existing locations, and marketing/advertising. In fact, of all the business types, education had the greatest percentage of applicants requesting loans for marketing and/or advertising. It’s important to note that public schools were not eligible for PPP funding, which means the PPP applicants were likely private schools or qualifying charter schools that sought to market their institutions to families seeking alternatives to homeschooling during the pandemic.

3. Expansion was still a focus among businesses seeking PPP loans

4. Real estate and construction businesses made up the largest percentage of PPP applicants

Equipment purchases came from businesses in the home repair and maintenance services. One survey showed that 76% of homeowners engaged in at least one home improvement project, which may have contributed to the increase in home repair and maintenance businesses seeking PPP loans.

Working capital requests came primarily from real estate investment companies, which isn’t surprising given the drop in demand for real estate near the beginning of the pandemic. However, demand started to bounce back in the summer of 2020, especially with the historically low mortgage interest rates. However, national housing inventory dropped drastically with a 39.6% decline over the course of 2020.

Expansion and marketing/advertising asks came primarily from general contractors. Sadly, in April 2020 alone, some 975,000 Americans lost construction related jobs, proving how dramatic an economic slowdown COVID-19 caused. While job loss occurred, it likely left business owners feeling a need to advertise services to keep business moving.

5. Information and media businesses used PPP funds to keep up with growing demand for objective news during COVID-19

An increase in people’s desire to receive reputable news about the pandemic and other global issues, which is also suggested by increases in the number of those who pay for their news. This includes a 20% increase in the U.S. and a 42% increase in Norway for paid news services online.

An increase in overall “news consumption for mainstream media” where surveys were conducted “before and after the pandemic.”

A “60% increase in the amount of video content watched globally,” likely due to the number of people at home, according to Nielson.

6. Despite the increased need for medical care, healthcare businesses suffered job loss and economic uncertainty

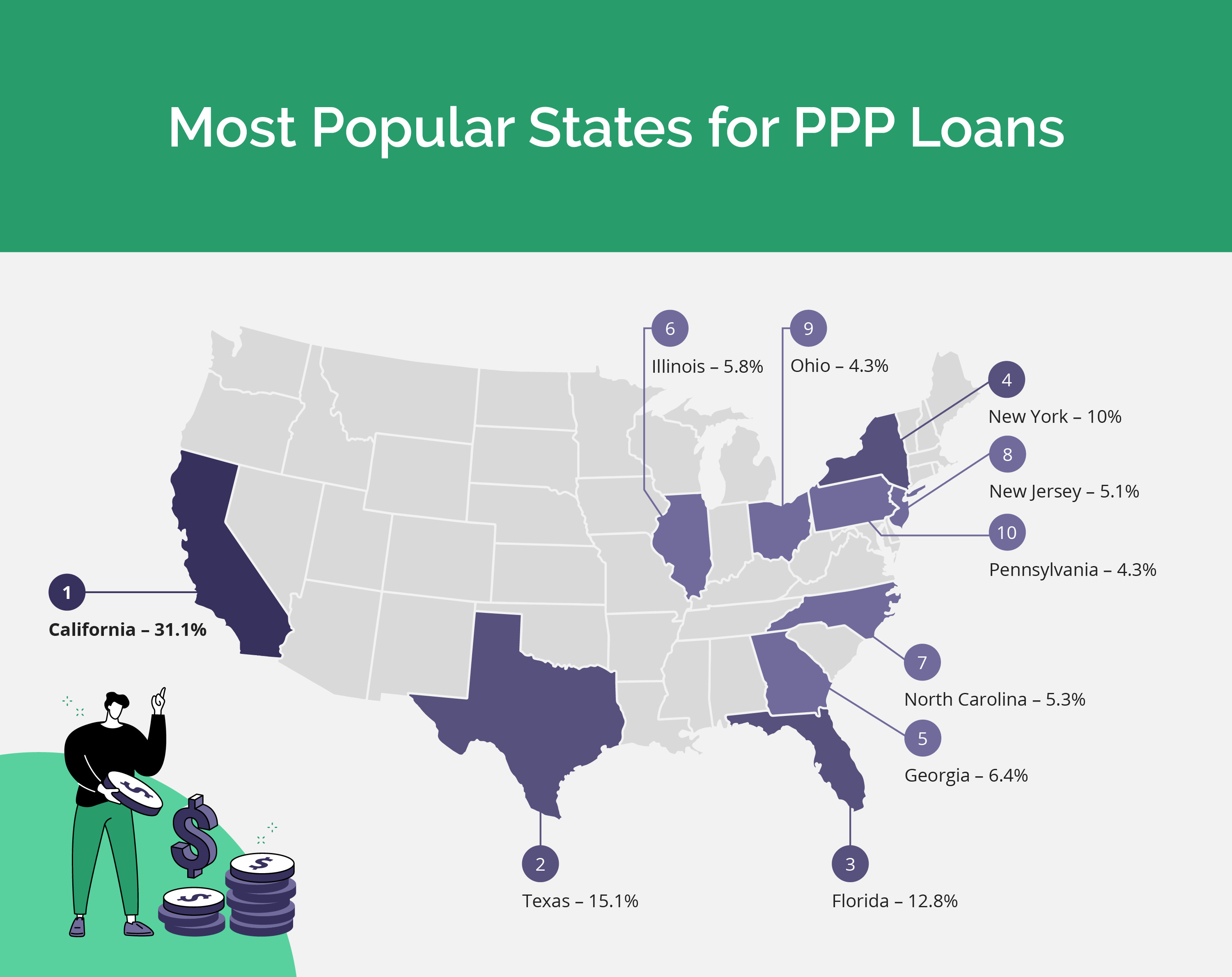

7. More than 30% of PPP applications came from California, but businesses in that state received only about 12% of the total PPP loans that were granted

8. The average requested PPP loan amount was under $100k

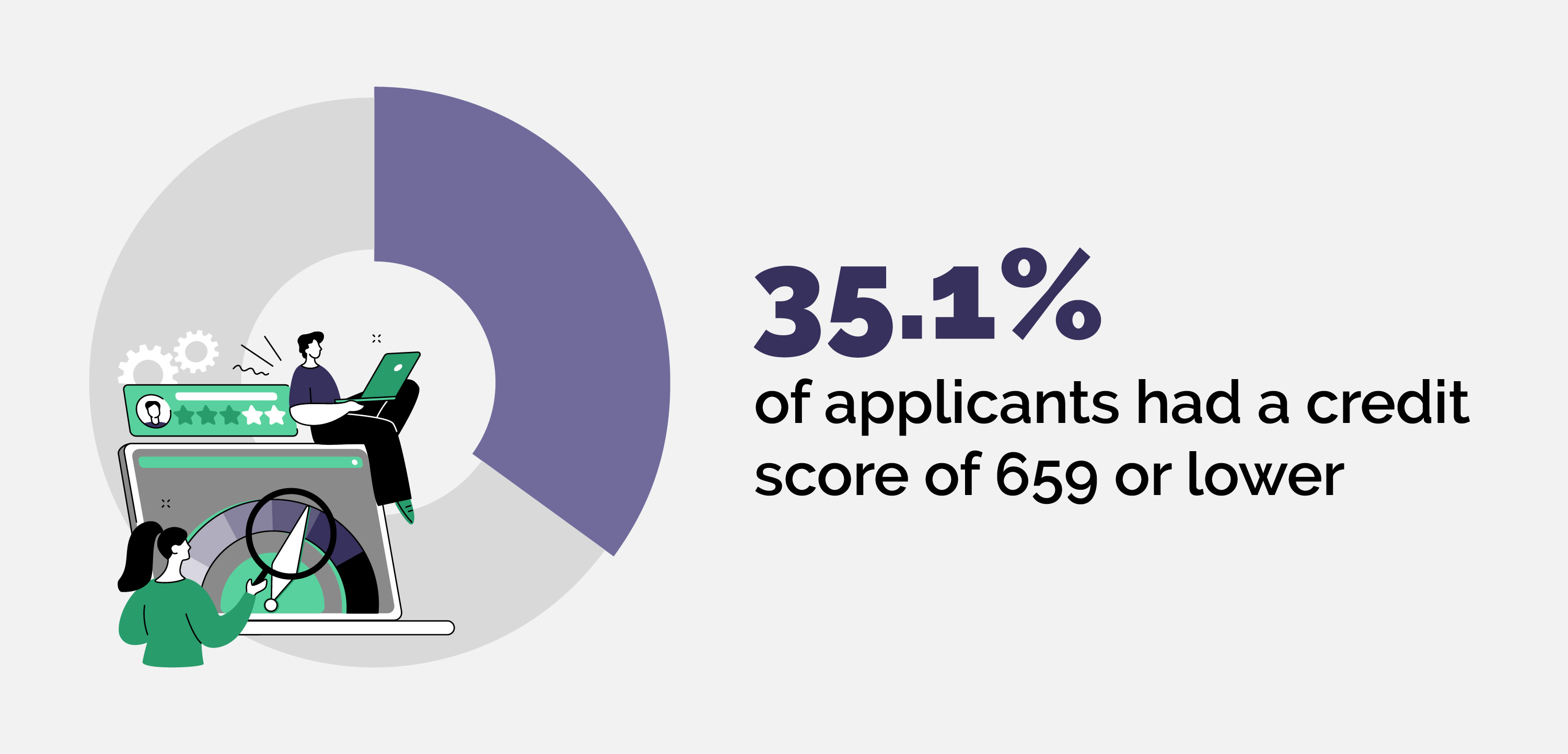

9. More than one-third of PPP applicants did not have a good credit rating

Funding for Your Business in 2021 and Beyond

Methodology

Proprietary data from Lantern's 2020 PPP application Proprietary data from Lantern's non-PPP applications in 2020 The SBA's latest report on dispersed PPP funds (through August 2020)

SOLC21044

About the Author

Lantern is a product comparison site that makes it easy for individuals to shop for products and compare offers with top lenders. Lantern is owned and operated by SoFi Lending Corp., the digital personal finance company that has helped over one million people get their money right.

Share this article: