Guide to Merchant Cash Advances (MCAs)

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

What Is a Merchant Cash Advance?

Merchant Cash Advance Example

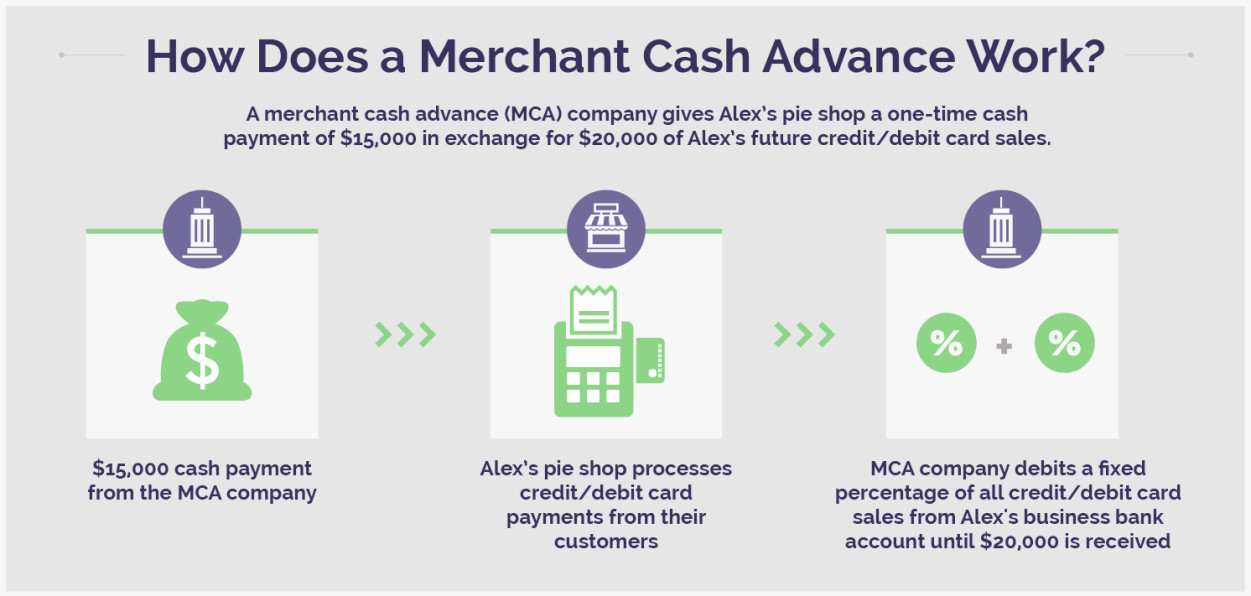

How a Merchant Cash Advance Works

Taking a percentage of the merchant’s daily debit or credit card deposits Withdrawing funds directly from the merchant’s bank account on a fixed schedule

Factor Rate Used for Merchant Cash Advances

The type of industry your business operates in Your business’ financial history Credit/debit card sales Number of years in business

Small Business Loan vs. Merchant Cash Advance

Equipment financing Invoice factoring SBA loans Small business loans Working capital loans Online business loans

4 Common Uses for a Merchant Cash Advance

1. Fill Cash Flow Gaps

2. Emergency/Unexpected Expenses

3. Inventory

4. Seasonal Fluctuations

Start-ups with little to no business history Those who have low or no credit, and don’t want to apply for a bad credit business loan Small business owners who don’t have collateral to offer Pioneers in new industries Businesses unable to qualify for loans from banks, credit unions, or online lenders

Benefits and Risks of Merchant Cash Advances

Pros of Using MCAs

Quick funding: Unlike a traditional loan, you can expect to receive funds in a matter of days. Minimal paperwork: Merchant lenders offering a cash advance typically require a simple application and want to see basic financial information about your business, like a record of recent credit card transactions. Unsecured: Business owners do not need to offer collateral to obtain a merchant cash advance. Payments may change with sales: If the merchant cash advance is based on a percentage of sales, the repayment amount might adjust depending on the success of your business. Don’t need perfect credit: If you have low credit scores, haven’t established business credit, or are struggling to get a short- or long-term business loan, a merchant cash advance can help supplement.

Cons of Using MCAs

Expensive: Factor rates are typically 1.1 to 1.5, depending on terms and conditions of the MCA. When you consider additional fees and APRs possibly in the triple digits, a merchant cash advance can be significantly more costly than a traditional loan. No advantage to early repayment: With a merchant cash advance, you typically pay a set amount regardless of how much of the balance you’ve paid off. Merchant cash advances do not amortize like a loan, in which case you could pay less interest when you pay off the balance early. Lack of government oversight: Because MCAs are considered to be a commercial transaction, merchant cash advance companies can offer cash advances to those who otherwise may not qualify for a small business loan. However, the lack of specific government regulation can also lead to questionable financing practices and less protection for your business. Don’t promote good credit: Merchant cash advance companies are not required to report to credit agencies. If you’re trying to build good business credit, using an MCA is unlikely to help the same way a loan would. Hard to get out of debt: If you struggle to get loans, relying on high-APR merchant cash advances has the potential to keep you in a debt cycle that can be hard to get out of. Cash flow restriction: While using an MCA can help secure funding in the short term, it could hurt cash flow in the long term. If you agreed to give your merchant lender a high percentage of your daily credit/debit card transactions, for example, cash flow may run leaner during the MCA repayment period, especially if your sales are high.

What If You Default on an MCA?

Applying for a Merchant Cash Advance

Fill out an application: A merchant lender may ask for basic identification like your Social Security number, business tax ID (EIN), and contact information. Collect and provide necessary documentation: This can vary depending on the MCA company, but you may need records of credit card transactions, business banking statements, lease agreements, gross revenue, and tax returns. Approval: Getting a decision can take as little as 24 hours or a few days depending on the company. Set up credit card processing: Your business may be required to set up credit card processing with a specific partner of the MCA provider.

Alternatives to Merchant Cash Advances

Invoice Factoring

Inventory Financing

Equipment Financing

SBA Loans

Personal Loans

Commercial Real Estate Loans

Business Credit Cards

Online Small Business Loans

Business Lines of Credit

Compare Small Business Loan Rates

Frequently Asked Questions

LCSB0923003

About the Author

Lantern is a product comparison site that makes it easy for individuals to shop for products and compare offers with top lenders. Lantern is owned and operated by SoFi Lending Corp., the digital personal finance company that has helped over one million people get their money right.

Share this article: