Business Line of Credit: Compare Lenders

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

What Is a Business Line of Credit?

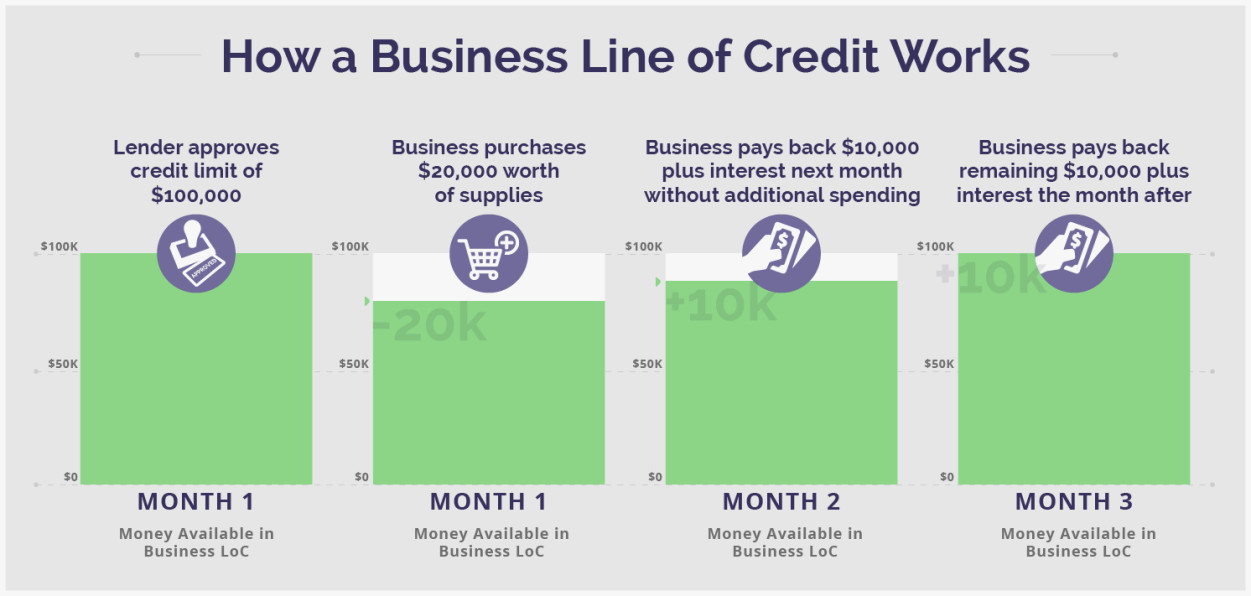

How Does a Business Line of Credit Work?

Repayment Options

Short-term repayment plans typically span six to 12 months. Because the repayment period is shorter, the interest rates may be higher. However, you could end up paying less overall compared to a long-term line of credit. Additionally, if you’re short on time, applying for a short-term line of credit with an online lender may yield a faster turnaround time compared to long-term lines of credit.

Long-term repayment plans typically exceed 12 months. Because the lender takes on more risk with a long-term line of credit, the application and approval process for these business lines of credit may be more rigorous. Long-term lines of credit may be helpful if you anticipate needing access to funds for cash flow and small business expenses over a longer period.

Costs of Using a Business Line of Credit

Interest Rates

Annual Percentage Rate (APR)

What Fees Apply to a Business Line of Credit?

Origination fees: Lenders may charge a fee for processing your business line of credit application. The origination fee may cover other costs, like underwriting and processing fees, and is usually a percentage of the total loan. Late fees: If you’re late on a payment or miss it completely, you may be charged a late fee. Annual fees: Some lenders may apply yearly fees based on the amount of your line of credit. For example, if you have a maximum credit limit of $25,000, you may have an annual fee less than if your line of credit was over $25,000. Cash advance fees: Some lenders may apply a fee if you ask for a cash advance, which may be a flat rate or a percentage of the cash advance. Upfront and renewal fees: Your lender may charge these fees when you apply for a new line of credit or renew an existing one. Termination fees: Some lenders charge a fee for ending your line of credit before the full term is over. This is typically a percentage of the line of credit. Prepayment fees: If you pay down your balance early, some lenders may charge prepayment fees, typically a percentage of the loan principal.

Difference Between a Secured and Unsecured Business Line of Credit

Secured Lines of Credit

Unsecured Lines of Credit

Revolving vs. Non-Revolving Lines of Credit

Revolving Line of Credit

Non-Revolving Line of Credit

How Can a Business Line of Credit Be Used?

Payroll Rent Operational expenses Inventory purchases Repairs Supplies Marketing Cash flow gaps

Requirements to Obtain a Business Line of Credit

How to Apply for a Business Line of Credit

1. Determine if a Business Line of Credit Is Your Best Option

2. See if Your Business Is a Good Candidate for a Line of Credit

Credit score: Check your personal and business credit scores. The higher your score, the better options you may have regarding credit limits and interest rates. Revenue: Lenders typically assess your monthly and yearly revenue to determine how capable you are of paying back your line of credit. If they see consistent growth, they may be more likely to lend to you or increase your line of credit. Personal investment: Lenders may also look at what you have invested in the business because it shows that you have a personal stake in your company's success. Collateral: Collateral can help get secured lines of credit with higher credit limits and lower interest rates. Age of business: Lenders often prefer established companies — the longer you've been open, the better your rates, terms, and possibility of approval may be.

3. Compare Lender Options

Traditional banks: Traditional banks typically offer favorable interest rates and business loan terms, but they often prefer a long business history and significant revenue. Credit unions: Credit unions may offer lower rates due to their business structure, which their members support. They are also tax-exempt and are required to reinvest profits back into their programs. Like traditional banks, requirements may be more stringent. Online lenders: If you need a business line of credit quickly and don’t meet typical qualifications, an online lender may be a good option. However, online lenders may have higher interest rates and lower credit limits than banks and credit unions.

4. Gather the Necessary Documentation

Personal identification: Lenders need to verify your identity, which may include a driver’s license or Social Security number. Business financial statements: This includes monthly bank statements, balance sheets, tax returns, revenue projections, and more. Business plan: While business plans are typically associated with grants, some line of credit lenders may want to see them, too. Legal documents: All proof that your business operates according to local, state, and national laws, such as business licenses, may be needed. Proof of collateral: If you want a secured business line of credit, you may need to provide documentation that shows you have the collateral available.

5. Apply

Alternate Financing Options to a Business LOC

Invoice factoring: Invoice factoring uses unpaid invoices as collateral to receive a cash advance. Inventory financing: This is used to pay for products to sell in the future. The inventory acts as collateral for the loan. Equipment financing: This type of financing pays for machinery, vehicles, or other business-related equipment, with the equipment acting as collateral for the loan. SBA loans: Backed by the U.S. Small Business Administration, SBA loans are offered by banks and other approved lenders. Interest rates are typically lower than with other types of financing, but the approval process can take months. Personal loans: Personal loans are based on your personal credit history, debt-to-income ratio, and income. Personal loans can be used for business expenses. Commercial real estate loans: These loans purchase buildings for business use. Business credit cards: Business credit cards use a revolving line of credit with interest charged on unpaid balances from previous billing cycles. Online loans: Online lenders offer similar loan options to traditional banks, but typically have a faster approval process and may provide more opportunities for people with lower credit scores.

Compare Lenders in One Simple Step

Frequently Asked Questions

LCSB1023004

About the Author

Lantern is a product comparison site that makes it easy for individuals to shop for products and compare offers with top lenders. Lantern is owned and operated by SoFi Lending Corp., the digital personal finance company that has helped over one million people get their money right.

Share this article: