Top Debt Consolidation Loans of 2024

Simplify your finances. Compare and see today’s rates.

How much would you like to consolidate?

Poor (300 - 619)

Fair (620 - 659)

Good (660 - 719)

Excellent (720 - 850)

See Debt Consolidation Rates in Minutes

Key Points

Debt consolidation loans allow you to pay off all or most of your high-interest debts. You then make one monthly payment on the direct consolidation loan, ideally at a much lower interest rate.

The average credit card interest rate is 21.47%, whereas the average personal loan interest rate is 12.35% (as of Q4 2023). Using a direct consolidation loan or personal loan to pay off credit card debt can save you hundreds or thousands of dollars in interest over the life of the loan.

Pros of debt consolidation loans include saving money on interest, managing one monthly payment instead of many, and possibly building your credit.

Cons of debt consolidation loans include possible hefty fees and possibly not qualifying for low interest rates.

Alternatives to debt consolidation loans include home equity loans, balance transfer credit cards, using a debt settlement company, and working with a credit counseling service.

What Are Debt Consolidation Loans?

A debt consolidation loan is a personal loan taken out to pay off other debts. If you qualify for a personal loan rate that’s lower than the rates on your credit card and other debts, you may be able to save money on interest over the life of the loan. You may compare personal loan interest rates when looking for debt consolidation loans.

The average credit card interest rate is 21.47% as of the fourth quarter of 2023 (according to the Federal Reserve’s most recent report on credit card accounts assessed interest).

Another advantage of debt consolidation loans is that they typically offer a fixed interest rate and a fixed loan term. So unlike credit cards, the interest rate won’t change — and your payment amounts will be the same every month. (You can also get a variable rate on a personal loan, in which case your monthly payments wouldn’t stay the same throughout the loan term.)

How Do Personal Loans for Debt Consolidation Work?

A personal loan for debt consolidation should ideally pay off other debts and not add to your debt load. So it’s a good idea to add up your current high-interest debts and borrow just that amount.

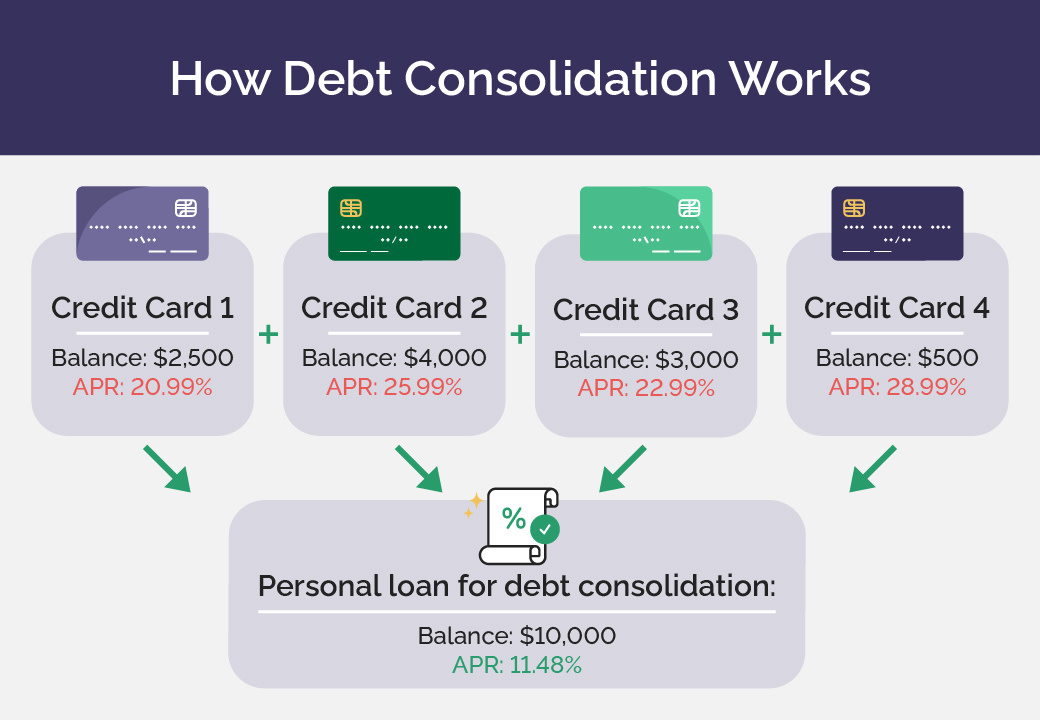

For example, say you have four credit cards with a total balance of $10,000 across those accounts and variable annual percentage rates (APRs) of between 20.99% and 28.99%. You could apply for a $10,000 personal loan to pay off that high-interest credit card debt.

The average interest rate on a 24-month personal loan is 12.35% as of Q4 2023 (according to the Fed’s most recent report). If you qualify for the average rate (or better), you can pay off your high-cost credit card balances with a debt consolidation loan that reduces your interest costs.

After you apply and your credit card consolidation loan is approved, the loan proceeds are distributed in one lump sum. Some lenders will deposit the money into your account, and then you pay off the high-interest debts yourself. Other lenders may pay those creditors directly, saving you that step.

From that point, you will be responsible for the monthly payment on the new personal loan.

Can Any Debt Be Consolidated?

Typically, unsecured debt like credit card debt or medical bills can be consolidated with a personal loan. With the average credit card debt rising, this option can prove attractive.

However, not all debts are candidates for consolidation. It’s usually not an option for car loans or mortgages, which are secured debt.

Federal student loans cannot be consolidated with a personal loan, but there are other options for managing student loan debt. If your credit is better now than it was when you originally took out the loans, you may be able to refinance your student loans with a private lender for potentially lower rates.

Or, you can consolidate several federal student loans into a single Direct Consolidation Loan from the government to make payments more convenient. Note: If you refinance your federal loans with a private lender, you lose eligibility for federal student loan debt relief and forgiveness programs.

Pros and Cons of Debt Consolidation Loans

Debt consolidation loans have benefits and drawbacks. They aren’t right for replacing every kind of debt or for every individual’s financial situation.

Pros of debt consolidation loans | Cons of debt consolidation loans |

Typically feature predictable monthly payments with a fixed interest rate | Some loans have fees and other charges |

May help debtors build credit | Your debt isn’t forgiven |

Potentially low interest rate | Some people don’t qualify for low interest rates |

Pros of debt consolidation loans

Here’s an overview on some pros of debt consolidation loans:

Fixed Interest Rates

Many personal loans have fixed interest rates rather than variable interest rates — they remain the same over the term of the loan. If the rate on your personal loan for debt consolidation is lower than the interest rates on the debts you’re consolidating, you’ll likely save money on interest, depending on the loan term. (Choosing a very long loan term, like 10 years, may offset the savings from having a lower interest rate, especially if the new interest rate is only a little lower.)

Building Credit

Taking out a personal loan may help you build credit, which is one of the top personal loan benefits. The lender will typically do a hard pull of your credit when you apply for a personal loan, which can temporarily drop your credit score a few points. But consolidating high-interest debts with a lower-interest loan may diversify your mix of credit as listed on your credit report.

Simplifying Payments

With a personal loan for debt consolidation, there is only one payment per month, as opposed to the multiple payments of the other debts. What’s more, if you get a fixed rate, the payment will be the same every month, which makes it easier to plan or schedule automatic payments.

Potentially Low Interest Rates

Qualifying for a debt consolidation loan that has a lower interest rate than your current debts could potentially save you money. Factors that influence consolidation loan rates include:

Your credit score. If you have a good credit score, you pose less of a risk to the lender, meaning you’ll likely qualify for a lower rate.

The loan term. Longer loan terms present more risk to the lender, so rates tend to be higher.

Your current financials. Lenders will assess your creditworthiness based on factors like monthly income, debt-to-income ratio (monthly debt divided by monthly income), and existing debt. A lower debt-to-income ratio also indicates less risk to the lender, meaning they may offer you a lower rate.

Recommended: How to Calculate Credit Card Interest

Cons of debt consolidation loans

Here’s an overview on some cons of debt consolidation loans:

Some Lenders Charge Fees

Any fee a lender charges on a loan will be included in the loan agreement. It’s important to read and understand the loan terms and requirements before signing anything.

Not all lenders charge fees, so compare lenders before you choose one. One common fee is an origination fee, which can be between 1% and 10% of the total loan amount. Other fees to look out for include late fees and prepayment penalties.

It's Still Debt

Consolidating debt doesn’t erase your debt — you just owe the new lender. But ideally, your repayment is on better terms. In order to keep your debt manageable, you may want to change your spending habits and only borrow money if it’s necessary to meet your goals.

Not Everyone Qualifies for Lower Interest Rates

One common goal of debt consolidation is to get an interest rate that is lower than the rate or rates you’re currently paying. Of course, qualifying for the best rate depends a lot on your credit score.

If you don’t have great credit, there are debt consolidation loans specifically for bad credit. These lenders will work with you so you can get the most favorable terms possible with your credit score.

Another option is to skip debt consolidation and focus on finding a repayment strategy that works for you.

When Can Debt Consolidation Be a Good Idea?

A personal loan for debt consolidation has many benefits, but is getting one right for you? You’re likely a good candidate if:

You can consistently make timely payments, since late and missed payments can add fees and other charges to your loan balance.

You qualify for an interest rate that’s lower than the rate or rates on the debts you plan to consolidate.

You feel overwhelmed by the number of monthly payments you have — and have been missing them.

Getting a Debt Consolidation Loan

Every lender will have its specific qualifications, but borrowers are typically required to:

Be at least 18 years old

Be a U.S. resident

Not be in bankruptcy or foreclosure proceedings

Have credit scores above 660 to qualify for favorable rates and terms

Have a debt-to-income ratio below 45 percent

Check your credit score and gather necessary documents

Before applying for a personal loan for debt consolidation, a little prep work may increase your chances of qualifying for a loan with a favorable interest rate and terms.

Start by requesting free copies of your credit report from Equifax®, Experian®, and TransUnion® at AnnualCreditReport.com. Make sure to review your credit reports thoroughly, reporting any inaccuracies or errors to the pertinent agency.

If your credit score is too low to qualify for favorable rates and terms, you may want to wait until you can make some positive changes to your credit report before applying for a loan.

If you’ve checked your credit report and are confident in proceeding with the personal loan application, gathering relevant paperwork is the next step. You’ll likely need to verify your legal name, current address, and income. Your chosen lender will let you know exactly what documents they will accept and what information they need to verify.

Recommended: Guide to Personal Loan Qualifications

Compare with debt consolidation lenders

Comparing lenders — specifically their interest rates, fees, and other charges — is a good strategy to find the best debt consolidation loan for your needs.

Keep your credit score in mind and be realistic about which loans you qualify for. You may also want to look for lenders who specialize in debt consolidation.

See if the lenders you’re interested in offer prequalification, which involves the lender conducting a soft credit check and letting you know how much they’d lend you based on your qualifications. If you prequalify for the amount you desire, you can then submit an official application. Note: Prequalifying or getting preapproval for a loan does not guarantee loan approval.

Submit your application for a debt consolidation loan

On the application, you will likely need to provide personal information (name, address, Social Security number), credit score, and income to prove your credit trustworthiness and eligibility.

You can generally expect to hear back from the lender within a few days. If you get approved for the loan, the lender will provide the next steps for setting an agreement.

Debt Consolidation Loan Alternatives

If you decide that debt consolidation isn’t for you, there are quite a few alternatives to consider.

Home equity loan

Tapping into your home equity is a standard alternative to debt consolidation. This is because it’s not uncommon for a person’s home to be their largest investment and, therefore, their largest asset.

Your home equity is based on the current value of your home minus how much you owe on your mortgage. For example, if your home is valued at $200,000 and you owe $125,000 on the mortgage, you would have an estimated $75,000 worth of equity.

Lenders will typically lend up to 80% of the amount of home equity to qualified applicants. In the above example, you might be able to borrow up to $60,000 in the form of a home equity loan or home equity line of credit (HELOC).

Since home equity loans and HELOCs tap into the equity in your home, you must pledge your home as collateral to guarantee the loan. If you do not pay the loan, you risk losing your home.

Debt settlement

Credit card debt forgiveness is an appealing option if you can get it.

Debt settlement companies may be able to help reduce the amount of debt you owe. For a fee, a debt settlement company will negotiate with your creditors and/or debt collection companies for you. If successful, this strategy can help you avoid bankruptcy.

Using a debt settlement company may hurt your credit. Typically, you pay the debt settlement company instead of your creditors directly. Then, the company will pay the creditor when the negotiation is complete.

Even after a debt is settled, how it’s reported to the credit bureaus is up to the lender. They will often close the account and report it either as “paid-settled” or “paid as agreed.”

Balance transfers

Another debt consolidation alternative is credit card balance transfers. This is simply the process of transferring outstanding debt from one credit card to another. This method is only ideal if you can pay off your debt during the low, introductory APR period of the new balance-transfer credit card.

You usually need to have a good credit score to try this option, and you will be responsible for paying any balance transfer fees. Finally, your balance limit can affect how much debt you can consolidate.

Overall, this method can be a good way to wrest control of high-interest debt, especially if you use a card with a 0% introductory APR offer (the longer the 0% APR period, the better, of course).

Credit counseling

Working with a nonprofit or for-profit credit counseling service is a viable debt consolidation alternative. A credit counseling company can help you enroll in a debt management plan (DMP) to pay your debts. As part of the DMP, a credit counselor will typically help you set a budget, discuss the reason for the debt, and craft a strategy to ensure a better financial future.

Credit counselors may offer financial education services on various topics. This may include advice about reading your credit card statement and managing debt. Working with a legitimate nonprofit credit counseling company is recommended by the Federal Trade Commission. You may pay a fee, but it will likely be lower than that of a for-profit credit counselor.

The Takeaway

A personal loan to consolidate debt may be one way to get on a healthy financial path, simplify your money management, and potentially pay off your debt sooner. If you have a better credit score now than when you first took on debt, you may be able to save money by consolidating and repaying your debts at a lower rate.

If you need a debt consolidation loan, Lantern by SoFi can help. Just fill out a simple form and compare rates from lenders in our marketplace.

Lantern can help you find personal loans for debt consolidation.

LCPL0224001