Guide to Microloans & Their Uses

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

What Is a Microloan?

Working capital Inventory or supplies Furniture or fixtures Machinery or equipment Initial startup expenses

Common Microloan Rates and Terms

Loan amount How funds will be used Specific lender requirements Needs of the borrower

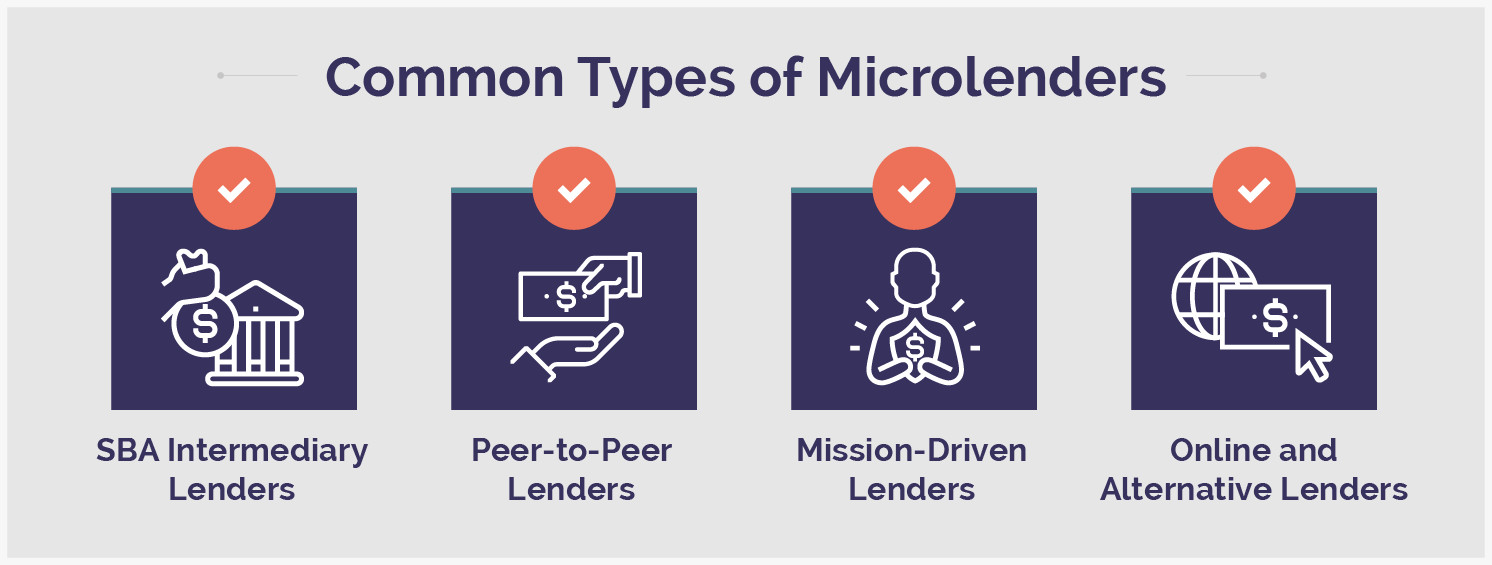

4 Types of Microloans

1. SBA Microloans

2. Peer-to-Peer (P2P) Microlenders

3. Mission-Driven Microlenders

Community Development Banks Community Development Credit Unions Community Development Loan Funds Community Development Venture Capital Funds

4. Online and Alternative Lenders

Crowdfunding sites Online small business lenders Angel investors Venture capitalists Friends and family

Pros and Cons of Microlending

Pros of Microloans

More flexible borrower qualifications Additional services (training, marketing, counseling) Fast turnaround time on application and access to funding

Cons of Microloans

Smaller loan amounts Some microloans have limits on how funds can be spent Potentially higher interest rates than a traditional bank

How To Get a Microloan in 4 Steps

1. Creating a Business Plan

2. Determining Eligibility

Be the sole business owner or co-owner of a for-profit small business Have no recent bankruptcies, late payments, outstanding tax liens, or foreclosures Have the ability to repay the loan with current income/revenue Proof of good payment history with creditors Have a clear, strong business plan for the future Meet any special demographic requirements (e.g. veteran, minority, low-income), when applicable

3. Choosing a Microlender

4. Gathering Documents and Information

Government-issued ID Proof of income Business and personal financial statements How you’ll use the microloan A detailed business plan Proof of collateral, if applicable A list of references who can vouch for you personally and professionally

Lenders Who Offer Microloans

Alternatives to Microloans

Working Capital Loan

Business Line of Credit

Equipment Financing

Top Small Business Loans

Frequently Asked Questions

LCSB0623008

About the Author

Sulaiman Abdur-Rahman writes about personal loans, auto loans, student loans, and other personal finance topics for Lantern. He’s the recipient of more than 10 journalism awards and served as a New Jersey Society of Professional Journalists board member. An alumnus of the Philadelphia-based Temple University, Abdur-Rahman is a strong advocate of the First Amendment and freedom of speech.

Share this article: