What Is an Unsecured Business Loan?

Share this article:

Editor’s note: Lantern by SoFi seeks to provide content that is objective, independent and accurate. Writers are separate from our business operation and do not receive direct compensation from advertisers or partners. Read more about our Editorial Guidelines and How We Make Money.

Unsecured Business Loans Explained

Unsecured vs Secured Business Loans

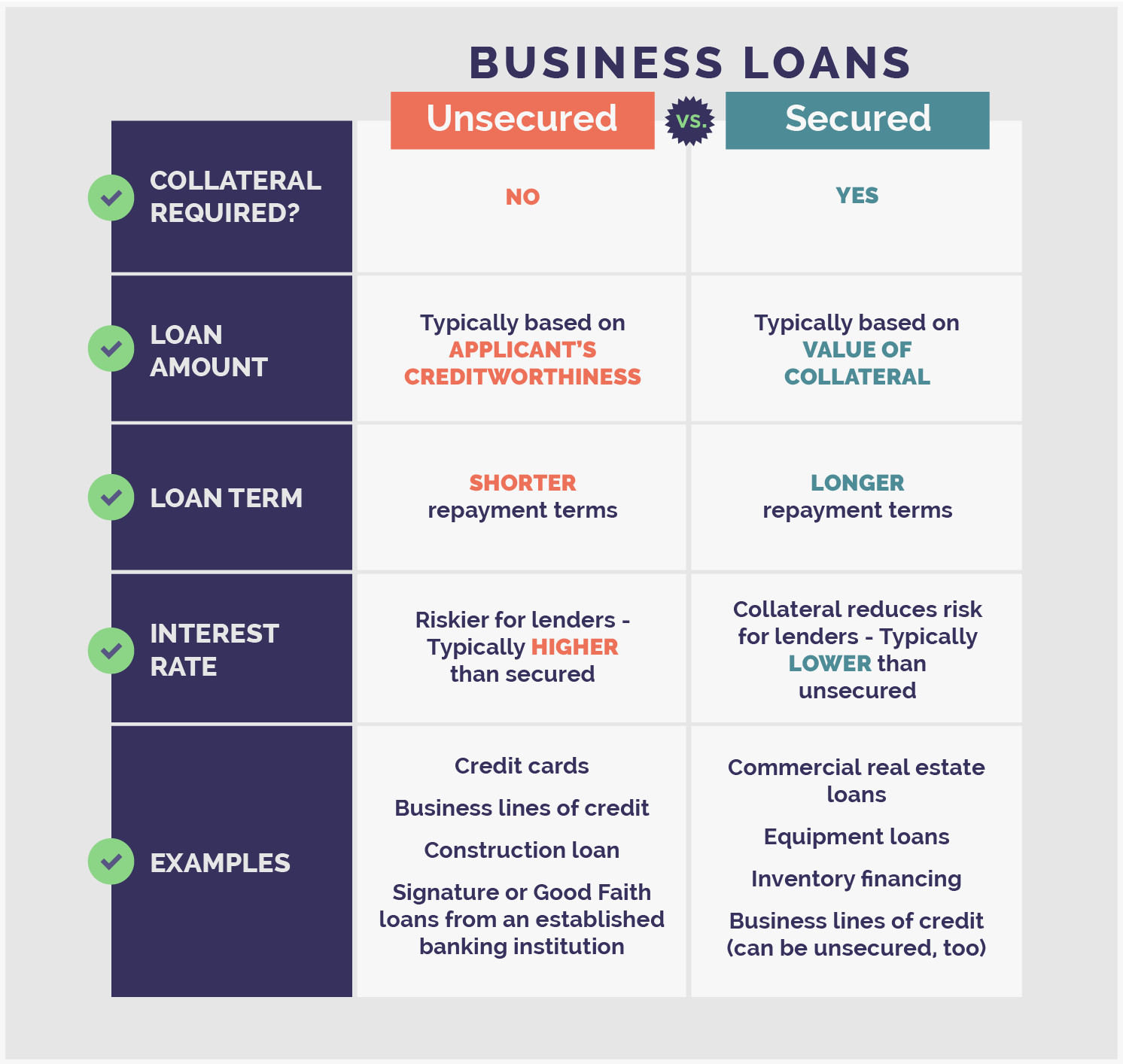

Secured loan amounts are typically determined by the loan-to-value ratio (LTV) of your collateral. Lenders use loan-to-value ratio to determine how much they choose to loan out based on the value of the collateral. Asset values can vary depending on the type of asset. For example, real estate that’s not considered “ready-to-go” may result in a loan amount that’s smaller than a piece of property that’s completely paid off. Lenders may also look at LTV differently, so it’s important to consult with individual lenders about how they calculate asset values.. Collateral can be business or personal assets. These may include real estate, vehicles, jewelry, collectibles, stocks and bonds, cash savings, and assets that can be converted into cash. Secured loans typically have longer repayment terms. Because a secured loan poses less risk, lenders typically give longer repayment periods compared to unsecured loans. Examples of secured loans: Mortgages, secured auto loans, home equity lines of credit, and commercial equity lines of credit (CELOC). Examples of unsecured loans: Student loans, unsecured personal loans, and business signature loans.

Risk of losing any pledged collateral (if the borrower defaults on repayment) Longer repayment terms mean you’re paying the loan for a longer period of time compared with unsecured business loans that typically have shorter terms Some secured loans may actually offer less financing than you’re looking for, because they’re based on the value of collateral, not just on the financial history of your business or your personal creditworthiness. Loan applications can take weeks or months to process if the lender requests to appraise the value of the collateral and how it’s tracked.

Pros and Cons of Unsecured Business Loans

Pros of Unsecured Business Loans

Faster potential turnaround time: No matter what type of business loan you’re seeking, lenders will likely conduct a thorough check on your qualifications. But an unsecured business loan typically requires less time to approve (since lenders do not need to vet and verify collateral). With a secured business loan, lenders generally need to assess the value and legitimacy of collateral, which can require more time. For borrowers who need fast business loans, an unsecured loan may be a good option. Lenders can’t seize property (without a court order): One of the risks of a secured business loan is having valuable assets seized if you default on the loan. With an unsecured business loan, lenders cannot seize business or personal property (without a court order), because no collateral has been pledged to the lender. Unsecured loans may be discharged if you file for bankruptcy: In the unfortunate event that your business has to file for bankruptcy, an unsecured business loan may be discharged, meaning you may not be liable for a business debt. Most unsecured loans are considered non-priority debt under various laws and, in some cases, may be discharged in bankruptcy. In contrast, discharging a secured loan in bankruptcy may not prevent a creditor from seizing the collateral. Lenders may have fewer restrictions on how you use funds: Unsecured business loans may give you more flexibility on how you can use the funds compared with secured business loans. Borrowers cannot, of course, use business loan funds for illegal purposes.

Cons of Unsecured Business Loans

Unsecured loans may have higher interest rates: The risk involved with providing an unsecured business loan can be significantly higher for lenders. Consequently, unsecured loans typically have higher interest rates for borrowers than the rates on a secured loan. Eligibility requirements: Without collateral, lenders may rely more heavily upon other eligibility requirements — factors like a loan applicant’s credit score, financial history, and business revenue. If you have poor credit or lack sufficient revenue, a lender may deny your application for an unsecured business loan and you may need to seek other loan options, like bad credit business loans. Smaller loan amounts: Due to the increased risk that comes with no collateral, lenders may not offer larger loan amounts. With a collateralized loan, lenders are more protected and may offer more funding. Personal guarantee may be required: Even though an unsecured business loan doesn’t require specific collateral, lenders may want a personal guarantee so they know the loan will be paid in the event of default. When you sign a personal guarantee, you are still responsible for paying back the loan even if your business dissolves, and lenders can still legally pursue a borrower’s personal assets, even if they aren’t noted as collateral.

Types of Unsecured Business Funding

Short-Term Loan

Loan with Personal Guarantee

Business Line of Credit

Invoice Factoring

Peer-to-Peer Lending

Merchant Cash Advance

6 Steps To Follow When Applying

1. Determine how much funding you need

What is the loan going to pay for? Is it absolutely necessary? How often will you be able to make payments? What is your ideal loan term? What is your budget? Do you have other sources of funding?

2. Understand what your business qualifies for

Personal and business credit history Minimum amount of time in business Business finances/revenue Monthly cash flow Business bank accounts

3. Decide which type of unsecured business funding is right for you

Short-term loans Loan with a personal guarantee Business line of credit Invoice factoring Merchant cash advance P2P lending

4. Compare lenders and financing options

5. Prepare documentation

Business financial records Personal and business credit reports Cash flow projections Business plan Identifying information, which may include citizenship Business legal documents Business and personal tax returns

6. Submit an application

Examples of Unsecured Business Loans

Alternatives to Unsecured Business Loans

Restaurant Loans

Franchise Financing

Equipment Financing

Personal Business Loans

Inventory Financing

Microloans

Commercial Real Estate Loans

The Takeaway

Frequently Asked Questions

LCSB1223021

About the Author

Lantern is a product comparison site that makes it easy for individuals to shop for products and compare offers with top lenders. Lantern is owned and operated by SoFi Lending Corp., the digital personal finance company that has helped over one million people get their money right.

Share this article: